Financial statements for the year ended 30 June 2008

Summary

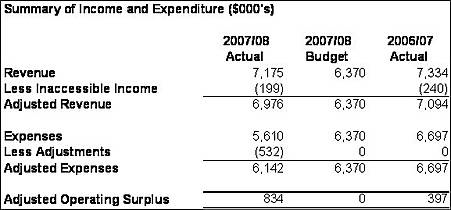

Assembly accounts were in surplus in 2007/08, continuing a run of surpluses over the last three years. On an adjusted basis operating results were in surplus to $834,000 against a budget that provided for balanced accounts. This result was largely brought about by higher than expected income.

Adjustments, as set out in the table above, were for inaccessible income of $199,000 (interest earnings on Trust accounts that Assembly cannot access), a one-off reduction in provisioning for doubtful debts of $440,000 and prior period adjustments of $92,000 related to over accruals and study leave liability.

Key Points

Financial Performance:

- Total adjusted revenue is $118,000 less than last year. Revenue variances on 2006/07 include:

- $520,000 reduction in Assembly Assessment income. Part of this ($370,000) was to compensate parishes for the transfer of responsibility for the payment of Ministers’ seniority allowance. The balance however reflected a general reduction in the levy made possible by income from other sources.

- During the year eleven houses made available for the use of Knox Centre were sold. The proceeds from the sales were invested and increased interest income by about $200,000. The houses recorded a gain on sale of $36,000.

- Property Income included $91,000 backdated rent resulting from a rental increase on a Christchurch commercial investment property

- Income from grants and donation was $246,000 greater than 2006/07 because of the significant support received from the Synod of Otago and Southland, and the continuing success of the Global Mission office in securing donation income. This is a major factor in explaining the surplus compared to budget.

- Miscellaneous income shows a reduction of $294,000, mainly due to the previous year recording about $220,000 in registration income for the 2006 General Assembly.

- Adjusted operating expenses were $555,000 less than 2006/07.

- The provision for doubtful debts was reduced by $67,000, a $440,000 change from the annual provision as provided in the 2006/07 accounts. A greater than anticipated collection of Assembly Assessment outstandings and other debtors has enabled a reduction in the provision to a more realistic, and yet still conservative, level.

- Staff costs of $1,662,000 were slightly less than last year even after taking into account Knox centre redundancy costs of about $80,000. Staff numbers, and cost showed reductions in the finance, communications and human resources functions.

- Discontinuation of centralised payment of Ministers’ seniority allowance represents a cost saving of $368,000. This was offset by a reduction in Assembly Assessment income as outlined above.

- Administrative functions that recorded cost reductions on the previous year include travel, depreciation, computers, communications, audit and insurance.

- A $67,000 increase in consultancy costs reflected fees incurred by national mission, youth ministry and human resources functions, and due to a general ledger restructure project that is expected to reduce IT management fees this year.

Financial Position

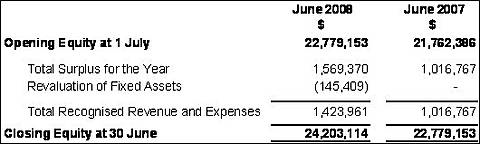

- The value of land and buildings reduced by $3,043,000 because of the sale of Knox Centre houses. The remaining houses were adjusted down in value by $145,000 on June 30.

- Funds payable increased by $180,000 due to sums received by Knox Centre, and by a further $186,000 relating to a loan payable to Presbyterian Investment and Savings on behalf of Bethlehem Community Church. Council of World Mission Funds on deposit remained about the same at just over $600,000.

- Presbyterian Investment Fund (PIF) deposits have been split into non-current deposits of $13,782,000, where the principal is inaccessible to General Assembly, and current assets of $6,775,000, being deposits which are available to use.

- Total funds deposited with PIF have increased by $4,789,000 due principally to the investment of funds received from the sale of houses ($2,975,000), retained interest and reinvestment of operating surplus.

Cash Flow

General Assembly had net cash inflow from operations for the year of $1,300,000. Accumulated cash reserves directly available to assembly increased by $800,000 to $1,600,000 and when added to funds provided from the sale of Knox Centre housing, and previously of Laughton House, provide a considerable resource with which to meet Assembly purposes.